We’re all looking for a “sure thing.”

An investment we know is going to make us money—no matter what.

Not long ago, people thought the stock market could only go up.

The S&P 500 in 2022 showed—yet again—why you should never rely on stocks to always go up.

The market was down nearly 20% for the year.

Just look at those ups and downs…

Frankly, this is the kind of volatility you’ll always see with stocks.

It’s why I personally have never invested much of my net worth in stocks.

You need to pay too much attention to them. You need to know exactly when to buy and when to sell—or you lose out.

The market has been on a rollercoaster since COVID and that doesn’t look to be stopping any time soon…

Who wants that kind of stress when it comes to money?

Checking your portfolio constantly to see what’s up and what’s down…

Lying awake at night wondering what price the market will open at…

I don’t need that kind of stress.

So, forget stocks…

What about bonds?

They used to be a “sure thing.” A safer bet than stocks.

But in 2022, bonds plummeted—the biggest losses in history. On the back of an already-bad 2021…

And the Great Bond Market Selloff of 2023 brought even more turmoil…

Bond fund managers are now looking at their third straight year of losses… the first time in 40 years this has happened.

What can you rely on to make money amid this chaos?

What’s the most valuable stuff in human history?

It’s not gold… or oil… or even food…

It’s real estate.

Property is the basis for civilization. It’s where you can base a city, raise a family, mine for gold, grow crops, breed animals…

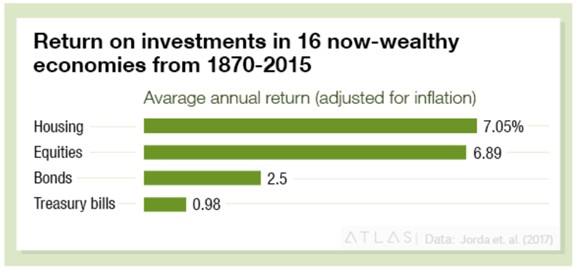

The National Bureau of Economic Research published a study covering 150 years up to the modern day…

Compared to equities, bonds, and treasury bills—real estate boasts the best long-term return of any asset class.

I’m a real estate investor. So, you could say I’m biased. But I’m just laying out the facts.

And here’s a truth about investing—any kind of investing—that big-time investors like me don’t usually admit.

Finding the best investments comes down to “who you know.”

It’s about having “insider information.”

Start Your New Life Today, Overseas

How The 1% Stay Rich…

You might be shocked to see me admit this.

But you probably know in your heart already that it’s true.

The truth is—the system is rigged.

We all know the best deals are made among the 1% behind closed doors…

They’re made out on the golf course, at $50,000 ticket charity events, or over expensive lunches after the board room meeting…

Wherever they happen, these are squarely insider deals.

Sometimes it’s insider trading, sometimes it’s perfectly legal, but rarely is it available to the ordinary investor…

It’s just like certain senators who sold off stocks mysteriously just in time before the coronavirus outbreak clobbered the stock markets.

Like Georgia Senator Kelly Loeffler, whose husband also happened to be the chairman of the New York Stock Exchange.

They sold $1.2 million in stocks after a Senate briefing on the global coronavirus outbreak… but before the spread of the disease in the U.S. was confirmed.

Not surprisingly, they saved themselves big losses when the market crashed.

Of course, they claimed their investment advisors made these decisions without their input…

But wouldn’t it have been nice to have intel like that in your pocket?

Rather than rail against the unfairness of all this… I’ve decided to join the insiders.

In The Room—In The Deal

“If you’re not in the room, you’re not in the deal.”

That’s a piece of business advice I take to heart.

I’ve spent decades searching the globe, on the hunt for the best real estate investments in places where few others dare to look—so I can grow my own wealth, and so I can bring those deals to members of my newsletter services.

I’ve traveled the costas and rivieras of the Mediterranean… hopped island chains in several seas… hacked through jungles in the Americas… and visited more development sites in these places than maybe anyone else on earth…

All with the goal of being “in the room” when real estate deals are done.

See, it’s only by understanding the local markets… and getting up close and personal with the people behind every project… seeing how their numbers stack up… that I can be confident that a proposed investment really is worth my time—or yours.

I’m proud of doing the legwork so you don’t have to.

Over the years, by spending time “in the room,” I’ve built up a trusted network of contacts. A Rolodex of dealmakers who’ll let me know when a great deal… a great buy… is available. And then I can bring it to my readers.

It’s taken me 30 years to get to this point. But now I have people I trust—people on the ground and in the market—in Latin America, Europe, the Middle East, Asia, and beyond: developers, attorneys, investment firms…

I’ve brought readers along for the profits with so many deals by this point…

And today I’m inviting you to join me with an even more exclusive deal…

Here’s the story…

Consistent Profits

I would never have heard about this specific deal except for my insider on the ground. This contact gave me the tip-off…

When I heard the numbers, I could scarcely believe it.

I had to audit the numbers myself… and it turned out the numbers were very real.

The opportunity is very real.

I’m talking about the chance to see consistent results like:

· 6%+ annual cash payments

· 10% returns every year

· 100% pre-tax profits

While retail investors run around looking for “1,000%” gains… steady and strong numbers like the above are what make the elite wealthy.

These specific profits are enjoyed by investors with a company you’ve never heard of…

They don’t advertise. They like to fly under the radar.

In fact, they almost always do business by word-of-mouth…

This is an old-school investment firm. Discreet. Personal.

But this firm has built more than $4 billion worth of real estate.

And they’ve brought returns like those I mentioned to investors in their deals…

Stay diversified,

Lief Simon

Editor, Simon Letter