Uruguay: Tranquil Beach Life, Cheap Health Care, And First World Infrastructure

The second smallest country in South America, Uruguay, has a predominantly flat terrain. Its endless plains are speckled with vineyards, producing some of the best wine in South America.

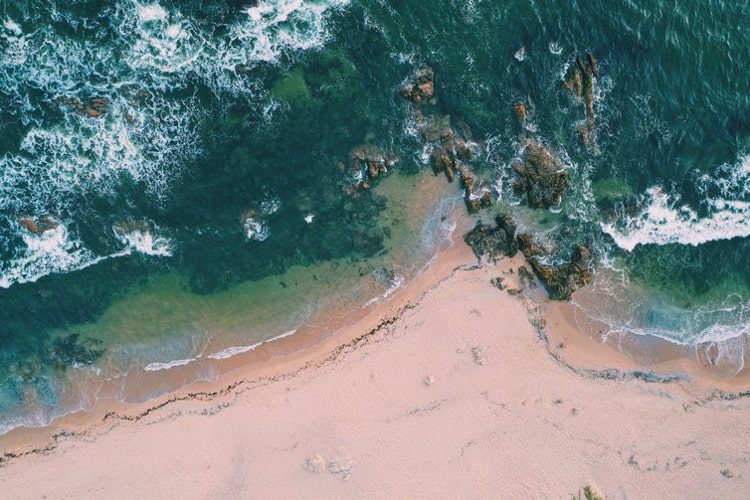

Uruguay also has a spectacular coastline, featuring some of the continent’s most luxurious beach resorts. Despite Uruguay’s abundance of natural attractions, this hidden gem remains largely undiscovered by North American expats.

“The Switzerland Of South America”

Located on South America’s eastern seaboard, Uruguay is surrounded by Brazil and Argentina.

The South Atlantic Ocean forms its eastern and southern borders, while Río de la Plata (Río Uruguay) makes up the western border. The capital city of Montevideo—the southernmost capital in the western hemisphere—is home to almost half of Uruguay’s 3.5 million residents.

Roughly the size of the U.S. state of Missouri, Uruguay occupies about the same latitude in the southern hemisphere as the state of Georgia does in the north.

The Uruguayan people are primarily of Spanish and northern Italian descent, with Italians having the most significant cultural influence. Despite being a former Spanish colony, present-day Uruguay has a culture without significant Spanish influence, aside from the language.

Uruguay’s colonial heritage and strong economy make for a country with a European feel. This, combined with its pleasant climate, high standard of living, and beautiful natural features, make Uruguay a prime retirement spot for North American expats.

Living In Uruguay

Once you’ve established foreign residency, Uruguay is one of the easiest places in the world to obtain citizenship and a second passport.

The Uruguayan government is a stable democracy, and the country enjoys a solid banking system, which grants it the nickname “the Switzerland of South America.” The legal system is based on civil law, and the judiciary is fair and stable.

It also has one of the lowest crime rates in Latin America, one of the lowest poverty levels, highest standards of living, and the longest life expectancy.

Uruguay enjoys four distinct seasons, and its 41-inch rainfall is spread evenly throughout the year, without any wet or dry season—although rain is uncommon in the mid-summer months of January and February.

The average daytime high temperature is about 82°F in midsummer, with the average low around 65°F. In mid-winter, highs run around 60°F, with the lows near 42°F.

Frost is rare in Uruguay, and it never snows. Few people use air conditioning due to the cool evenings and ocean breeze, but you’ll want to use the heat in the wintertime.

The official language of Uruguay is Spanish. However, it’s unlike what you would have learned in school or spoken in Mexico or Costa Rica.

Uruguayan Spanish shows a strong Portuguese influence, with a lot of words that simply don’t exist in other Spanish-speaking countries.

But don’t worry. If you already speak Spanish, you’ll do fine with whatever version you’ve learned. If you don’t know a word of Spanish, you will need to carry a phrasebook with you, as English is not spoken widely in Uruguay, especially outside of the bigger cities.

Cost Of Living In Uruguay

Not too long ago, Uruguay had one of the cheapest costs of living in Latin America.

Fast forward to nowadays, and life here is not so cheap. That’s not to say it’s not good value for money. Uruguay offers a high quality of life for a fraction of what you would pay in the States, yet it remains significantly more expensive than other popular expat destinations.

One of the biggest costs in Uruguay is owning a car. If you choose to buy a car, expect to pay more than you would in the U.S. or Canada due to Uruguay’s high automotive import duties.

On the flip side, health care is relatively cheap, so these costs more or less balance out.

Health Care In Uruguay

Uruguay is paving the way for countries across the world with its unique health care system. Everyone is entitled to decent health care. For many, this means using the public health care system, available to natives and foreign residents alike.

Health care is free for those with low incomes. For others, you can expect to pay about US$75 for the ER service, doctor visit, and related lab work.

While that’s pretty inexpensive for modern emergency care, you’d save much more going down the private route—even if you’re in Uruguay just part of the year.

Uruguay’s private health care system, called Mutualista, does not operate as health insurance, like in other countries. Instead, members pay a monthly membership to a private hospital of around US$100. This system does not operate with deductibles or a lifetime cap, making it more beneficial for the member.

Getting To Uruguay

So, you’ve made the decision, next stop—Uruguay. But how to go about getting there? Direct flights from the United States to Uruguay are rare.

You will more than likely need to get a connecting flight from Panama or Peru.

Another option is to fly to Buenos Aires and drive to Uruguay, a road trip of around eight hours.

When it comes to transporting your stuff, hundreds of companies are available online ready to transport your belongings directly from door to door.

If you are planning on bringing your furry friends with you, the good news is that pets are welcome in Uruguay. Each must be accompanied by a USDA-approved health certificate attesting to rabies vaccination, general health, and a tapeworm shot for dogs.

The animal’s exam must have been conducted within 10 days of your departure for Uruguay.

Best Places To Live In Uruguay

La Barra

La Barra sits on Uruguay’s Atlantic coast, almost halfway between Montevideo and the border with Brazil. It’s a town with beautiful beaches, great restaurants, quiet wooded neighborhoods, and more nightlife than you would imagine for a place this size.

For some reason, seaside La Barra has been overshadowed by its more famous neighbors, yet it has everything you could want in a retirement destination.

It is a small, “walkable” town, yet it offers all the luxuries, services, comforts, and conveniences you could want. Furthermore, La Barra is clean, well-maintained, and safe.

In La Barra, Uruguay, you find several areas where the houses and low-rise apartments are right on the water, and even properties that aren’t on the water have good views.

La Barra sits on a gentle hill that offers beautiful ocean views throughout much of the town—more than you’d expect in this relatively flat country.

Costa De Oro

The Costa De Oro, or Gold Coast, is a 45 km long stretch along Uruguay’s southeast corner.

A four-hour drive away from the country’s capital, Montevideo, Costa De Oro is a perfect retreat for expats wanting to escape the hustle and bustle of Uruguay’s busy cities.

Costa De Oro comprises several beach resort towns, including the popular Atlántida. Here prices are much lower than in the luxury beach resorts down south.

Towns like Atlántida along the Costa De Oro are generally quiet in the wintertime but explode with visitors during the summer. This gives the best of both worlds to expats who decide to retire along Uruguay’s stunning Gold Coast.

Interactive Map Of Uruguay

Click on any highlighted city or region to explore in-depth guides on what life is like there—from cost of living and climate to culture and real estate opportunities. Each location featured is one we’ve carefully reviewed and consider among the most livable and investment-friendly spots in Uruguay. Use this map as your starting point for discovering where in Uruguay your ideal lifestyle awaits.

Where Is Uruguay Located?

Uruguay is located in on the East coast of South America. The country is bordered by Brazil to the North and Northeast, Argentina to the West, and the South Atlantic Ocean to the South and Southeast.

. '

. '

. '

. '

. '

. '

. '

. '

. '

. '